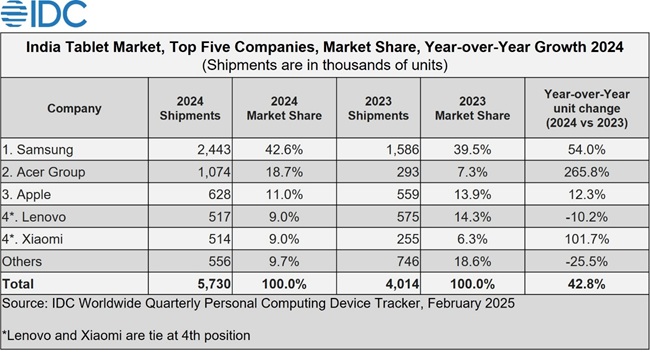

The Indian tablet market shipped 5.73 million units in 2024, marking a 42.8% increase from the previous year, according to IDC’s Worldwide Quarterly Personal Computing Device Tracker.

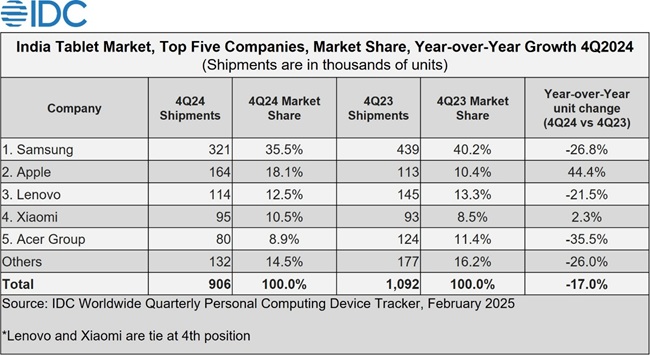

Detachable and slate tablet categories grew by 30% and 47.2% year-over-year (YoY), respectively. However, the market saw a 17% decline in Q4 2024 due to delays in some government manifesto deals.

Growth in Consumer Segment

The consumer segment grew by 19.2% YoY in 2024, driven by strong promotions, discounts, and cashback offers from eTailers. Samsung led this channel with a 24.4% share.

Growth in Commercial Segment

The commercial segment grew by 69.7% YoY, with the Education segment experiencing a remarkable 104.5% YoY growth due to increased government-funded education projects. Despite this, the Very Large Business (VLB) segment saw a 9.9% YoY decline.

Rise of Android Tablets

Android tablets are becoming more popular for light productivity and entertainment due to better cameras, software updates, and app integration. “Tablets are becoming the device of choice for light productivity and entertainment,” said Priyansh Tiwari, a research analyst at IDC India & South Asia.

Entry-Level Tablets and ASP

More than 60% of shipments were entry-level tablets (≤US$300), but the average selling price (ASP) increased from US$309 in FY2023 to US$336 in FY2024. Rising component costs have made tablets an attractive option compared to notebook PCs, added Tiwari.

Leading Companies in 2024

- Samsung: Led the market with a 42.6% share, dominating both commercial and consumer segments with 51.1% and 32.1% shares, respectively. Samsung had a 35.5% share in Q4 2024, driven by public sector education projects and strong online sales.

- Acer Group: Held an 18.7% share, excelling in the commercial segment with a 32.8% share due to key government and education deals. Acer had an 8.9% share in Q4 2024.

- Apple: Had an 11% share, performing well in both commercial and consumer segments, growing by 45.3% YoY and 4.7% YoY, respectively. The adoption of iPads by top management in enterprises and government ministries fueled growth. Apple had an 18.1% share in Q4 2024.

- Lenovo: Held a 9% share, with the consumer segment growing by 18.6% YoY due to strong demand for models priced between $150 and $250 in the eTailer channel. Lenovo had a 12.5% share in Q4 2024.

- Xiaomi: Also held a 9% share, with a 101.7% YoY growth driven by strong Q3 2024 shipments. Focus on offline and eTailer channels, along with new launches, led to this growth. Xiaomi had a 10.5% share in Q4 2024.

Future Outlook for 2025

Bharath Shenoy, research manager at IDC India & South Asia, stated that commercial tablets continue to be popular in several big-ticket manifesto deals.

The acceptance of tablets in sectors like FMCG, hospitality, and BFSI is rising, and with AI-powered tablets expected to launch soon, the tablet market is likely to maintain its growth momentum in the consumer segment as well, concluded Shenoy.